Vietnam’s Economic Resilience in Reducing Reliance on Single Markets

Since 2017, Vietnam has been deeply integrated into the global economy, with its trade exceeding 200% of GDP. The country maintains trade relations with over 150 countries, but its trade is predominantly with China, South Korea, and the United States. In 2020, the U.S. and China accounted for 45% of Vietnam’s exports, while imports from China and South Korea rose to 50%, with a third coming from China. Vietnam’s reliance on these countries, especially for intermediate goods like semi-processed products and capital goods, has led to significant trade deficits.

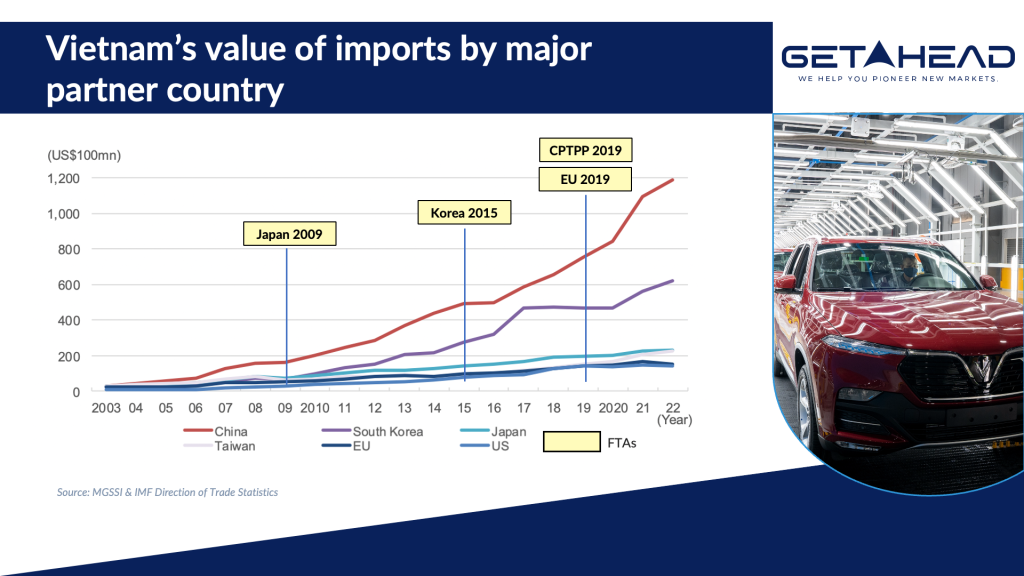

To mitigate this reliance, Vietnam has actively pursued diversification strategies. This includes signing Free Trade Agreements (FTAs) with various countries regions to diversify its trade relations and reduce its dependency on China. These agreements are aimed at reducing Vietnam’s dependency on Chinese imports by broadening its trade partnerships and developing alternative supply chains, particularly in sectors where it heavily relies on Chinese imports. Participating in the CPTPP and EVFTA also supports Vietnam’s economic restructuring. For example, the two FTAs require products made in Vietnam to use a certain percentage of inputs originating from member states to enjoy preferential treatments offered in these agreements. This will encourage Vietnamese enterprises to use inputs from domestic sources, which, in turn, will stimulate the country’s supporting industries. Before domestic suppliers can meet the demand, Vietnamese firms will need to import inputs from CPTPP and EU partners, thereby helping Vietnam reduce imports from China. Some of the significant FTAs Vietnam has signed, along with their dates, and the ones that have the potential to reduce imports from China:

- ASEAN Free Trade Area (AFTA): Established in 1992, AFTA includes all the ASEAN member countries. By reducing trade barriers within the ASEAN region, it provides an alternative market and supply chain options for Vietnam.

- Vietnam-EU Free Trade Agreement (EVFTA): Signed on June 30, 2019, and effective from August 1, 2020. EVFTA opens significant opportunities for Vietnam to increase its trade with EU member countries, potentially reducing reliance on Chinese imports, especially in technology and machinery.

- Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP): Signed on March 8, 2018, and effective from January 14, 2019, for Vietnam. This agreement includes countries like Japan, Canada, Australia, and Mexico, providing Vietnam access to large markets outside of China, especially for electronics and textiles.

- Vietnam-Korea Free Trade Agreement (VKFTA): Effective from December 20, 2015. South Korea is a major alternative source for technology and capital goods, potentially reducing Vietnam’s import reliance on China.

- Vietnam-Japan Economic Partnership Agreement (VJEPA): Effective from October 1, 2009. Japan is another key partner for technology and investment, offering alternatives to Chinese imports.

However, Vietnam’s endeavours to mitigate its trade dependence on China through these FTAs have not produced expected outcomes yet. After one year of CPTPP implementation, Vietnam’s trade deficit with China in 2019 continued to widen and reached a record high of US$32 billion, a 36% year-on-year increase. That year, Vietnam imported US$35.73 billion of capital goods and US$26.60 billion of intermediate goods from China, which accounted for 47.26% and 35.20% of all imports from China, respectively.

Besides FTAs, encouraging and investing in local production capabilities for goods previously imported from China also reduces dependency and supports the local economy. Intel has invested heavily in its facilities in Vietnam, particularly in Ho Chi Minh City, where it produces sophisticated microprocessors. This investment is a move towards creating a self-reliant manufacturing base, reducing reliance on Chinese components. Development of the Hi-Tech Park in Ho Chi Minh City attracts tech companies and encourage the development of technology and innovation within Vietnam, reducing the need for high-tech imports from China. VinFast, a Vietnamese automaker, is seeking to establish itself as a global electric vehicle manufacturer. This involves sourcing components from various global suppliers, reducing reliance on any single market, including China. Formosa Plastics Group, a Taiwanese conglomerate, has a significant investment in a steel mill in Vietnam, intended to reduce reliance on Chinese steel imports.

What does this mean for foreign businesses in Vietnam?

While the reliance on China for imports presents certain challenges, it also offers opportunities for businesses to innovate and localize production. There’s a growing market demand for diversification and local production, offering a niche for businesses that can provide alternatives to Chinese imports. Additionally, as Vietnam seeks to lessen its dependence on China, policy shifts might favor companies that contribute to this diversification. However, new entrants must navigate the complexities of import regulations and strive to meet Vietnamese standards, necessitating strong local networks and an understanding of the market dynamics to mitigate risks and seize opportunities.

Measures can include encouraging joint ventures and partnerships between Vietnamese and foreign companies to facilitate knowledge transfers, stockpiling essential goods to mitigate the risk of supply chain disruptions, implementing better supply chain monitoring and risk management strategies to anticipate and mitigate the impacts of dependence on any single country, including China.