How to Navigate US Export Restrictions on Critical and Conflict Minerals from China

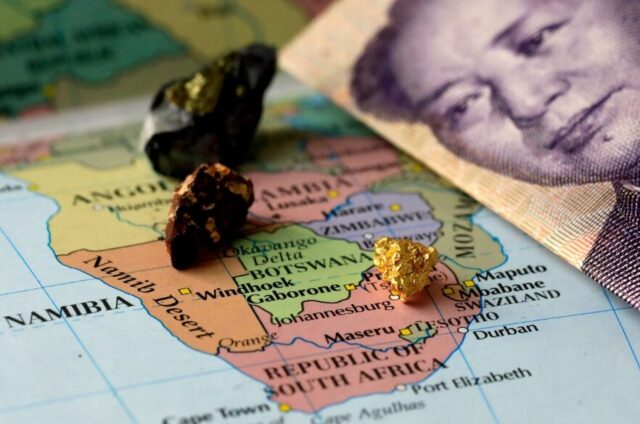

The Growing Challenge of Critical Minerals Sourcing

The competition for vital minerals is intensifying, and companies will probably encounter increasing difficulties in the near future. US manufacturing companies need to start reassessing their supply networks, especially those that rely on Chinese products. The more important questions are when disruptions will occur and how much of an impact they will have, not if they will occur at all. Businesses have always relied on China to provide a consistent supply of vital minerals. But that feeling of stability is eroding as geopolitical tensions rise. Although some businesses might try to acquire goods from middle-tier nations like Germany, this is only a short-term option. Even processed materials may become less accessible if trade restrictions become more stringent. Consequently, transparency within the supply chain has become more crucial than ever.

Sorowako, Indonesia (2019): A worker displays packaged nickel products prepared for export at the Sorowako smelter.

High-Risk Minerals and Supply Chain Transparency

Certain minerals present greater supply risks than others. Indium, tungsten, bismuth, tellurium, and molybdenum play significant roles in global manufacturing, yet a substantial portion of their raw materials continues to be sourced primarily from China. Although processed versions may currently air in international markets, their future availability is uncertain. The policies can change rapidly, impacting the supply chain, as much as they may appear stable initially.

Key Areas to Cover in an Initial Overview Analysis:

- Top Mining Countries : Identify where key minerals are extracted.

- Top Producers : Understand which companies refine and control supply

- Top Users : Recognize industries most dependent on these materials (e.g., aerospace, defense, medical imaging, industrial machining).

- Production Process Chain : Map out key processing steps and dependencies

- Market Volume Differences : Understand the different orders of magnitude of market size (e.g., Bismuth: annual 20,000 T production vs. Tellurium: annual 1,000 T production).

Looking at the origin of minerals is an important aspect of understanding their journey, but complications do not end there. Ownership and refining practices play an important role in this equation. For instance, a mine may be outside of China, but the reliance on these institutions will not change if Chinese corporations continue to manage their operations, investments, or processing facilities. Although it is difficult, opening these interconnects has grown in significance.

China’s Expanding Influence and the Weaponization of Minerals

China’s ambitions expand well beyond the control of raw materials. Consider the semiconductor industry, which was once seen as a counterweight for China’s dominance in important minerals. However, in recent months, China has significantly intensified its domestic chip production, strengthening its position within the global supply chains.

A major concern is that China’s strategic use of its mineral resources as a tool for economic lens. By selecting export sanctions selectively, China enhances its ability to influence industries around the world. Recent restrictions on major ingredients such as gallium, germanium and antimony clearly portray this strategy. As this dependence is deep, it becomes rapidly clear that minerals are not only resources, but also powerful bargaining tools in the comprehensive economic struggle.

Bor, Serbia (2019): The Veliki Krivelj mine of Zijin Bor Copper, one of the world’s largest copper reserves, operated by Chinese mining company Zijin Mining.

China’s financial maneuvers reveal a long-term strategy aimed at fostering economic resilience, such as allowing banks and insurers to hold gold. Additionally, the weaknesses of long supply chains have become clear, especially in electronics manufacturing sector, where important components such as printed circuit boards and mixing paste are highly dependent on Chinese processing. Emerging industries such as electric vehicles (EV) batteries and medical equipment are already experiencing the effects of these challenges.

Recent Restrictions and Their Implications

The initial wave of export sanctions has already begun. China’s ban on gallium, germanium, and antimony, effected in December 2024, signals what may come next. Although these measures mainly target American industries, European companies should not assume that they are free from potential effects. Trade restrictions often result in ripple effects, which may soon affect the European Union markets.

China remains the dominant supplier of heavy rare earths, essential for EVs, wind turbines and military technologies.

For manufacturers in aerospace, defense, and medical devices, the array of risks continues to grow. To navigate these challenges effectively, organizations should do more than just monitor policy shifts. Securing alternative supply sources proactively is essential to mitigate risks before shortages occur. Those who take early action will find themselves better positioned than those who wait until the last moment to respond.

How Businesses Can Secure Their Supply Chains

In the realm of securing essential materials, procrastination poses significant risks. The market environment is dynamic, and delays can lead to a lack of viable options when supplies dwindle.

Short-Term Solutions (Often Implemented Too Late in a Crisis)

- Prepare Data in Advance : Access to supply chain data can provide a critical advantage during urgent situations.

- Know Your Supply Chain : It is essential to have a thorough understanding of each component within the supply chain.

- Understand Critical Materials : Companies need a comprehensive overview of the restricted materials they depend on most heavily.

- Explore Alternative Materials : Investigate viable substitutes that could help mitigate dependence on high-risk resources.

- Act Early : When restrictions are enacted, materials can quickly become scarce in the market.

Long-Term Strategies for Resilience

- Diversify Sourcing : There are multiple sources for materials outside of China, although they may come at a premium.

- Strategic Stockpiling : Holding reserves can provide a cushion during shortages.

- Innovate Alternative Product Designs : Create alternative products that use fewer or no restricted materials (for instance, designing larger magnets that do not rely on rare earth elements).

Despite the clear signs indicating a need for action, many large corporations remain hesitant to invest in sectors such as mining. This caution comes at a cost, as it increases their vulnerability to future disruptions while competitors who take a proactive approach strengthen their positions. Adapting to these emerging challenges requires more than merely altering strategies; it calls for an essential shift in mindset. The current landscape signifies that this issue transcends mere business strategy—it is about survival in an increasingly unpredictable global market.

Final Thoughts: Be Prepared Before It’s Too Late

The shift is already happening. The only question is : Will your company be prepared when the next disruption comes?