The Role of Malaysia’s Strategic Location in Global Supply Chains

Malaysia’s strategic geographical position in Southeast Asia has always been an important factor in global trade dynamics. This advantage becomes increasingly crucial in the context of global supply chains, especially with the plan to build a RM28 billion (S$8.5 billion) port to significantly boost the handling capacity for both container and conventional cargo at the main shipping hub of Port Klang. This article analyzes how Malaysia’s location can be leveraged to optimize global supply chains and the implications for businesses involved in procurement.

Malaysia’s Geographical Edge

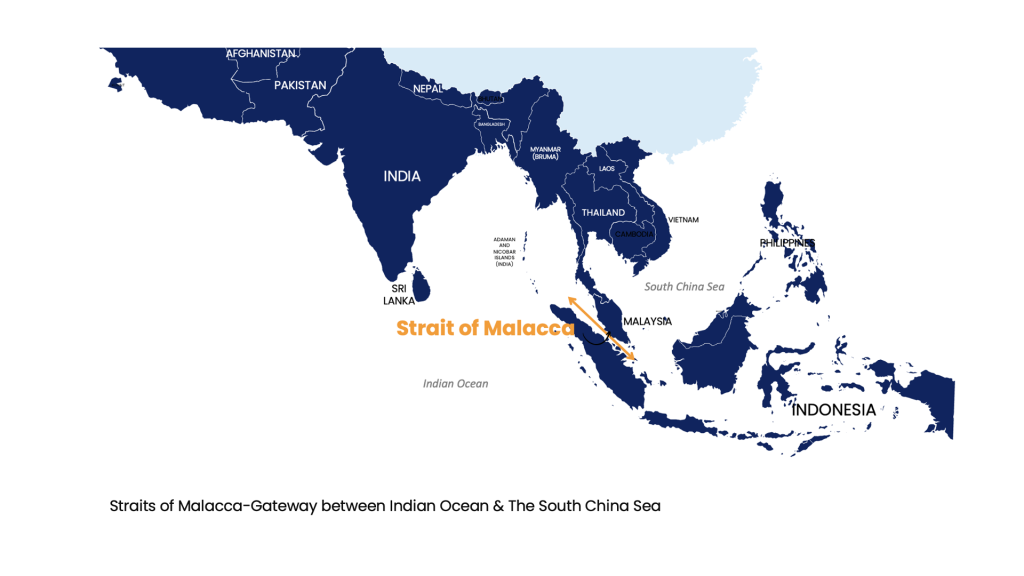

Situated between the Indian Ocean and the South China Sea, Malaysia is at the crossroads of major maritime trade routes. This location places the country in an ideal position to act as a hub for shipping and logistics, serving as a key intermediary point between the East and the West.

Optimizing Supply Chains through Malaysia’s Location

1. Transshipment Hub

The Malaysian government has confirmed it is going ahead with the plan to build a RM28 billion (S$8.5 billion) port at the main shipping hub of Port Klang, to rival regional ports that are in the midst of expansion, including those in Singapore, Thailand and Vietnam. It is projected to handle an impressive 36 million shipping containers (TEUs) annually, significantly more than Port Klang’s current capacity of about 13.2 million TEUs. expansion project is expected to start by the year end. The idea is that when expansion of Westports reaches its full capacity in 3 years, the additional container port capacity from Carey Island, which is expected to be phased in by then, would be needed.

Port Klang, located near Kuala Lumpur on Malaysia’s west coast, is the country’s largest port and ranks among the world’s top 20 busiest for container handling, with a capacity of over 13 million TEUs annually. It serves as a critical hub for manufacturing, electronics, and commodities, playing a vital role in trade with major economic partners like China, the United States, Europe, and ASEAN countries.

To the south, the Port of Tanjung Pelepas (PTP) in Johor, strategically situated near the Singapore Strait, rapidly grows with an annual capacity of about 10.5 million TEUs. PTP is essential for container handling, transshipment, and facilitating trade between Malaysia and Singapore.

Penang Port in the northwest caters to the northern region’s industrial and agricultural needs, supporting local economic sectors including tourism and agribusiness, despite a smaller container throughput compared to Port Klang and PTP.

On the east coast, Kuantan Port in Pahang is expanding to become a deep-water port, enhancing its ability to handle larger vessels and increased cargo, crucial for trade in the South China Sea and supporting oil, gas, manufacturing, and agricultural industries.

Bintulu Port in East Malaysia’s Sarawak is a key global LNG export terminal, supporting the region’s oil and gas, timber, and agriculture sectors, underscoring its strategic importance in Malaysia’s port infrastructure.

2. Gateway to ASEAN Markets

Malaysia’s proximity to ASEAN countries makes it an ideal gateway for businesses looking to penetrate these emerging markets. Procurement strategies can leverage Malaysia’s location to access a diverse range of products and services from across the region. Malaysia is also a member of ASEAN (Association of Southeast Asian Nations) and participates in various free trade agreements (FTAs) and economic partnerships within the region and beyond. This integration facilitates smoother trade flows and access to broader Asian markets.

3. Improved Connectivity and Infrastructure

The country’s well-developed infrastructure, including ports, airports, and road networks like North-South expressway and KTM railway, facilitates smooth and efficient movement of goods. This enhances supply chain reliability, a key consideration for procurement professionals.

4. Leveraging on Strategic Neighbours

Malaysia’s strategic location also allows for supply chains and collaborations with India. In manufacturing, major Indian companies like Reliance Group contribute to diverse fields such as textiles, chemicals, petroleum products, pharmaceuticals, and food manufacturing. In the services sector, prominent Indian firms like ICICI Bank, Wipro, Infosys, Tata Consultancy Services, and Manipal International have established operations in Malaysia, enhancing the service industry’s capacity.

Case Studies and Examples

Electronics and Automotive Industries: Malaysia has become a preferred location for electronics and automotive components manufacturing. Companies like Intel, Sony and Toyota have set up manufacturing bases in Malaysia, leveraging its strategic location for easier and cost-effective procurement and distribution. Intel’s facilities in Penang and Kulim focus on manufacturing and assembly of microprocessors and chipsets, leveraging Malaysia’s strategic location for easier access to Asian markets. Sony Corporation, the Japanese multinational conglomerate, has manufacturing plants in Malaysia. These facilities produce a range of consumer electronics, benefiting from Malaysia’s location for export efficiency across Asia and beyond.

E-Commerce and Regional Distribution Centers: E-commerce giants, such as Alibaba and Amazon, have established logistics and distribution centers in Malaysia. These centers act as regional hubs, capitalizing on Malaysia’s location to optimize their supply chain across Southeast Asia. Alibaba chose Malaysia to establish its first electronic world trade platform (eWTP) hub outside of China. This hub, located in Kuala Lumpur, serves as a regional logistics and distribution center, facilitating smoother and faster movement of goods in the ASEAN region. Amazon operates data centers in Malaysia, part of its Amazon Web Services (AWS) division. These centers support the company’s extensive cloud computing services, benefiting from Malaysia’s strategic location for better connectivity in the region.

Challenges and Considerations

While Malaysia’s location offers significant advantages, it is not without challenges. Political stability, regulatory environments, and labor market dynamics are factors that companies must consider when integrating Malaysia into their supply chain strategies.

Political Stability: Over the years, Malaysia has experienced some political fluctuations, which can lead to uncertainties in policy direction. For businesses, political instability can result in shifts in economic policies, affecting everything from import-export regulations to foreign investment incentives. Companies must stay alert on the political climate and be prepared for potential changes that could impact their operations.

Regulatory Environments: While Malaysia is generally business-friendly, its regulatory environment can be complex, with regulations varying between states and sectors. Navigating this landscape requires a thorough understanding of local laws and regulations, including taxation, customs procedures, environmental regulations, and labor laws. This complexity necessitates that companies either develop in-house expertise or seek local partners and advisors to ensure compliance.

Labour Market Dynamics: Malaysia boasts a skilled workforce, however, companies might face challenges such as competition for skilled labor, wage inflation, and labor law compliance. In certain industries, there’s a reliance on foreign labor, which can be subject to regulatory changes. Additionally, as the economy evolves, there’s an increasing need for upskilling and reskilling workers, especially in high-tech industries. Companies need to consider these factors for their human resource planning and operations.

Malaysia’s ambitious transition towards Industry 4.0 and its emphasis on technological advancement mean that businesses must also keep pace with the changing technological landscape and adapt their operations accordingly. Navigating these challenges successfully requires careful planning, adaptability, and a deep understanding of the local business environment. By doing so, companies can effectively integrate Malaysia into their global supply chain strategies, harnessing its location and resources while mitigating the associated risks.