The Impact of Trump’s Trade and Energy Policies on Global Supply Chains

Disruptions in Critical Supply Chains

Recent policy shifts in the United States, initiated by President Donald Trump’s return to office, are set to reshape global supply chains. With a strong emphasis on “America First,” the approach to trade, energy, and industry regulations has introduced uncertainty for businesses worldwide. From electric vehicle (EV) mandates to increased tariffs and energy policy shifts, global supply chains, particularly in Asia and Europe, are bracing for significant disruptions.

The EV Sector and Manufacturing Realignments

One of the most immediate and impactful decisions by the Trump administration has been the rollback of EV mandates introduced under Joe Biden. By revoking regulations that aimed to have EVs comprise 50% of new car sales by 2030, the U.S. is charting a different course from China and Europe, which remain committed to the transition away from combustion engines.

EV Production Line on Advanced Automated Smart Factory

For automakers, this means an increasingly fragmented global market. Japanese and South Korean car manufacturers, which have been gradually investing in EV production, may slow down their transition to accommodate shifting U.S. demand. Meanwhile, European and Chinese automakers will likely continue their push towards EV dominance. This divergence could lead to supply chain inefficiencies, as manufacturers must cater to different regulations in key global markets.

Tesla, which already holds a strong position in the U.S. EV market, is expected to benefit from reduced competition from startups and legacy automakers hesitant to invest further in EV technology. However, the overall market may experience slower growth, impacting battery suppliers and manufacturers dependent on U.S. demand.

Tariff Policies and Trade Disruptions

The potential reintroduction of steep tariffs on imports from Mexico and Canada poses a serious challenge to global manufacturers. Many Asian companies, particularly Japanese and South Korean automakers, operate extensive production facilities in these countries to serve the North American market. If Trump enforces tariffs as high as 25%, automakers like Honda, Mazda, and Kia will face increased production costs and supply chain disruptions.

While businesses are likely to take a measured approach to these policies, rather than making drastic changes, the uncertainty itself discourages long-term investments. Asian manufacturers may shift production toward alternative regions, but doing so requires time and financial resources that could strain profitability.

Additionally, the imposition of tariffs on Chinese imports remains a looming concern. Although Trump has hesitated to execute harsher trade barriers immediately, his administration has indicated a willingness to strengthen economic policies against China. This could affect critical sectors like consumer electronics, semiconductors, and industrial machinery, which rely heavily on Chinese-manufactured components.

Energy Policy Shifts and Global Implications

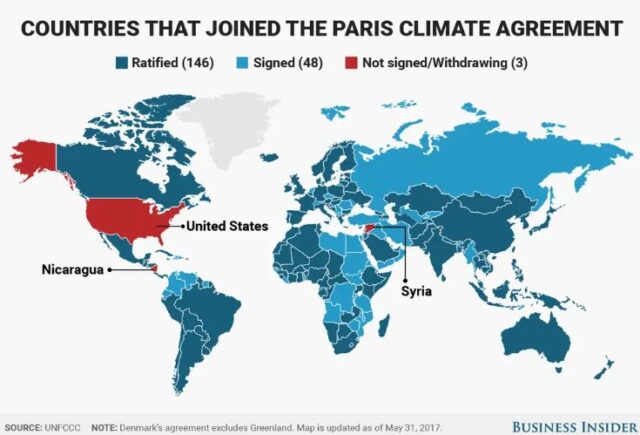

The U.S’s second withdrawal from the Paris Agreement, coupled with the declaration of a national energy emergency, has wide-reaching consequences. The push to boost fossil fuel production and reduce dependence on foreign energy sources aims to make the U.S. a dominant force in global energy markets. However, these policies could create ripple effects across industries that rely on stable and predictable energy costs.

The US will join Syria and Nicaragua as the only nations that aren’t part of the Paris agreement.

Asian and European economies, which have been aggressively investing in renewable energy, may find it harder to compete with U.S. fossil fuel exports. Countries dependent on oil and gas imports could benefit in the short term from increased supply, but a long-term shift away from clean energy investments in the U.S. may slow global efforts to decarbonize industries.

The Panama Canal and Geopolitical Ramifications

Trump’s call to “retake control” of the Panama Canal has sparked concerns about rising geopolitical tensions. The canal remains a crucial point for global trade, with significant volumes of goods transported between Asia, the Americas, and Europe. Any disruption in its operation—whether due to U.S. intervention or political instability—could severely impact supply chains, particularly for industries reliant on just-in-time shipping logistics.

China’s growing involvement in the Panama Canal, through Hong Kong-based Hutchison Port Holdings, is another source of contention. Any escalation of U.S.-China tensions over control of key trade routes could have far-reaching consequences for global commerce. Companies dependent on the smooth passage of goods through the canal may need to reassess their logistics strategies to mitigate potential risks.

Long-Term Consequences for Businesses

As businesses navigate this shifting landscape, several challenges emerge. First, the uncertainty surrounding U.S. trade and energy policies makes long-term investment planning more difficult. Companies must weigh the risks of continuing to rely on established supply networks against the potential benefits of diversifying sourcing strategies.

Second, industries that depend on global collaboration—such as aerospace, semiconductors, and advanced manufacturing—may face additional hurdles as trade barriers increase. If critical materials become subject to tariffs or supply chain disruptions, production delays and increased costs could follow.

Finally, businesses that fail to adapt to these changes risk falling behind competitors who take a proactive approach. Whether through reshoring production, investing in alternative supply routes, or securing long-term agreements with suppliers, companies that anticipate disruptions and act accordingly will be better positioned to battle future uncertainties.

The Need for Strategic Adaptation

The current global supply chain environment is becoming increasingly complex. Businesses must stay ahead by continuously assessing risks and adjusting their strategies accordingly. While some of Trump’s proposed policies may not be immediately implemented, the broader trend toward economic nationalism and protectionism signals a need for companies to build resilience into their supply chains.

The message is clear: adaptability is key. Through diversifying suppliers, investing in regional production hubs, or securing alternative logistics routes, companies must be prepared for a world where global trade is less predictable. The ability to respond swiftly to policy changes will separate those that thrive from those that struggle in an increasingly volatile economic landscape.