India’s Role in the Global Semiconductor and Photovoltaic Market

In the global landscape of technology and manufacturing, India’s semiconductor, electronics, chips, and photovoltaics industry is emerging as a significant player. With the world increasingly becoming digital and the demand for electronic goods surging, India is positioning itself not just as a market, but also as a hub for manufacturing and innovation.

Growth and Global Impact

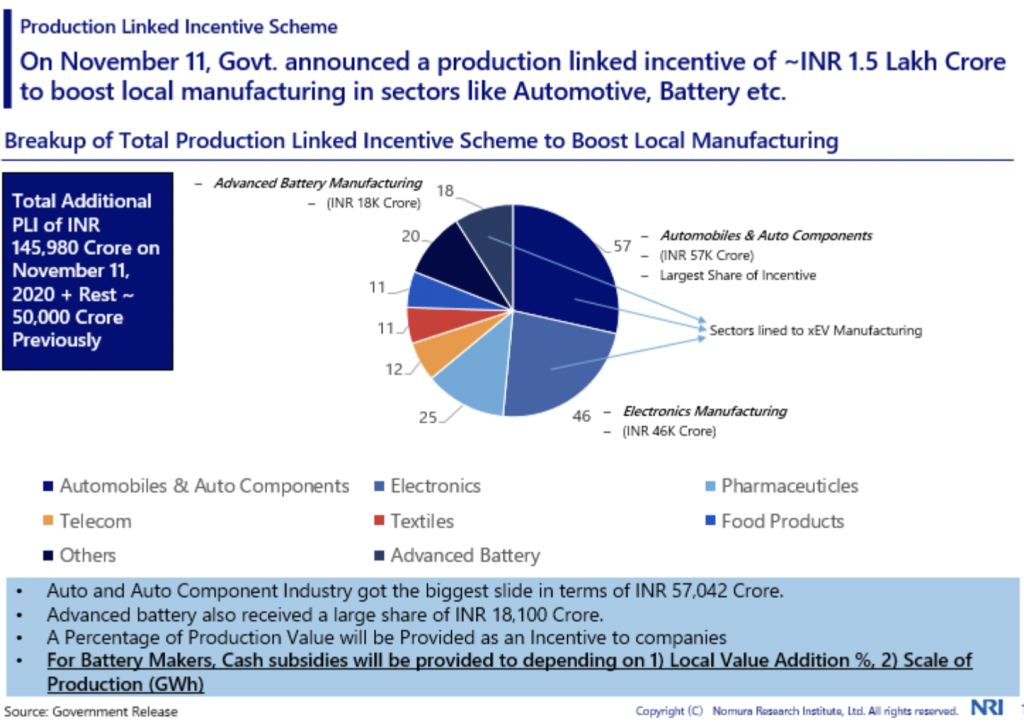

The Indian semiconductor and electronics industry has witnessed substantial growth over the past decade. With a market size projected to reach USD 400 billion by 2025, the sector is crucial for the country’s economy. India’s demographic advantage, with a large pool of engineers and a growing consumer market, positions it uniquely in the global arena. The government’s push, through initiatives like ‘Make in India’ and the recently introduced ‘Production Linked Incentive’ (PLI) scheme, is aimed at making the country a manufacturing powerhouse. Companies like Samsung and Foxconn have significantly increased their investment in India, capitalizing on these initiatives. Moreover, the rise in domestic manufacturing of electronic products, from mobile phones to solar photovoltaic cells, reflects the sector’s growing prowess.

Semiconductor and Electronics: The Core of Digital India

Semiconductors form the backbone of the electronics industry. Recognizing this, India is making progress to establish a self-reliant semiconductor ecosystem. The government’s ‘India Semiconductor Mission’ is a step towards fostering partnerships and attracting global semiconductor players to set up research and manufacturing facilities in the country. The India Semiconductor Mission attracts companies to set up manufacturing and R&D in India by offering substantial financial incentives, including capital expenditure subsidies and R&D support. The government is also developing semiconductor-specific infrastructure, like Semiconductor Fabs and specialized parks with advanced facilities. One example is the expansion of Samsung Electronics in India. The South Korean giant has invested significantly in setting up one of the world’s largest mobile manufacturing plants in Noida, Uttar Pradesh. This facility not only caters to the vast Indian market but also exports to several countries, intensifying India’s potential as a global manufacturing hub. Flex, an American multinational electronics contractmanufacturer, has a presence in India, with facilities in several locations, including Tamil Nadu and Karnataka. The company manufactures a wide range of electronic products and components. Bosch, known for its automotive components and electronics products, has multiple manufacturing and R&D facilities in India, contributing significantly to the country’s manufacturing sector.

Flex building in Bagmane Tech Park in C.V Raman Nagar Bangalore, also known as the I-Flex Solutions Building, built in 2005.

(Photo courtesy of Flex)

Despite the substantial local assembly, a significant portion of electronic components is still imported. This scenario underscores a gap in the local production of semiconductors and critical electronic components, spotlighting the need for enhanced investment in local manufacturing capabilities and technology upgradation. A case in point is the government’s ‘Production Linked Incentive’ (PLI) scheme aimed at promoting domestic manufacturing of electronic goods, including mobile phones and semiconductor components. Companies like Dixon Technologies and Lava International have benefitted under this scheme, ramping up their manufacturing capacities.

Credit: Namura Research institute

At the 2024 Vibrant Gujarat Summit, several significant announcements were made about semiconductor industry advancements in India. Micron Technology’s President and CEO, Sanjay Mehrotra, revealed that their plant in Sanand, Gujarat, is expected to start operations in early 2025, aiming to create 5,000 jobs upon completion of both project phases. South Korea’s Simmtech said it would open a chip component plant in Gujarat alongside the upcoming semiconductor testing and packaging facility of U.S. chipmaker Micron. Tata Group also announced its plan to establish a large semiconductor fabrication plant in Dholera, Gujarat, with operations anticipated to commence within the year. Dholera is an upcoming industrial city and is part of the Delhi-Mumbai Industrial Corridor, strategically located near the industrial hubs and ports and offers logistical advantages. The Indian government and the European Union have signed an MoU to foster a resilient semiconductor supply chain, exchange insights on their semiconductor ecosystems, pursue joint R&D and innovation, foster talent development in the semiconductor industry, and promote fair competition within the sector. HCL is in talks with Karnataka’s government to establish an Outsourced Semiconductor Assembly and Test (OSAT) facility with Foxconn, reflecting the country’s growing focus on semiconductor manufacturing and the aim to create a robust, self-reliant industry.

Photovoltaics: Harnessing the Power of the Sun

India’s photovoltaic industry is another area where significant growth is evident. The country’s ambitious target to achieve 100 GW of solar energy capacity by 2022 has led to a rapid increase in the production of solar cells and modules. Companies like Adani Green Energy and Tata Power Solar are leading the charge, with large-scale manufacturing facilities and extensive solar farms. The government’s support through schemes like the ‘National Solar Mission’ and incentives for domestic manufacturers is propelling the industry forward. Domestic companies like Adani Solar, Vikram Solar and Waaree Energies not only manufacture and supply modules and solar products to other countries, but have also entered into collaborations and partnerships with foreign entities to leverage global expertise, expand market reach, and enhance technological capabilities. Adani Green Energy and France’s Total Energies formed a joint venture to expedite solar power project development in India. Tata Power Solar partnered with Finland’s Fortum for a 250 MW solar plant in Rajasthan, combining expertise for India’s solar capacity growth. Vikram Solar allied with Germany’s Teamtechnik to enhance its module production efficiency and quality. Waaree Energies collaborated with China’s LONGi Solar to source advanced cells and improve module manufacturing efficiency.

These factors, combined with improvements in infrastructure and an evolving ecosystem of suppliers and service providers, make India an attractive destination for foreign businesses looking to diversify their production bases and tap into new market segments.