GetAhead Supply Chain Solutions on Stage at USC’s Asia-Pacific Business Forum in Indonesia

InterContinental Resort, Bali. GetAhead Founder Mathias Alt was on stage to share his experiences with Supplier Strategy and Search Consulting in Southeast Asia. In a spirit of unity but from refreshingly different backgrounds, four panelists dug deep on the topic of “Moving Operations from China: Exploring New Opportunities in Southeast Asia and India”.

Facing the “on and off” zero Covid policy in China, rising geopolitical tensions and a weaker economic growth outlook, moving operations away from China seems to be on the mind of many business leaders. Many seek to balance their supply sources by setting a stronger emphasis on Southeast Asia and India.

Why we still continue to rely on China

Using the example of IT giant Apple which recently relocated iphone 14 manufacturing capacities from China to India, the limits become clear: many of the world’s most experienced tooling and die shops are still in China. Looking behind the headlines of media reports, it becomes apparent that Apple has only moved assembly out of China (not components) and that the new site in India is still owned by its supplier Foxconn.

In our current sourcing projects at GetAhead Pte. Ltd., we could personally experience that through their big local-for-local production, Chinese suppliers are not only in the unique position to offer big synergies with world production, they are also part of a well connected ecosystem of suppliers and sub suppliers. Despite all the current difficulties, China still has an excellent infrastructure for export.

Another angle that was brought into the discussion was AI. China is the leading nation in collecting data and applying AI. Can companies afford to no longer be present in the Chinese market and miss out on innovations ?

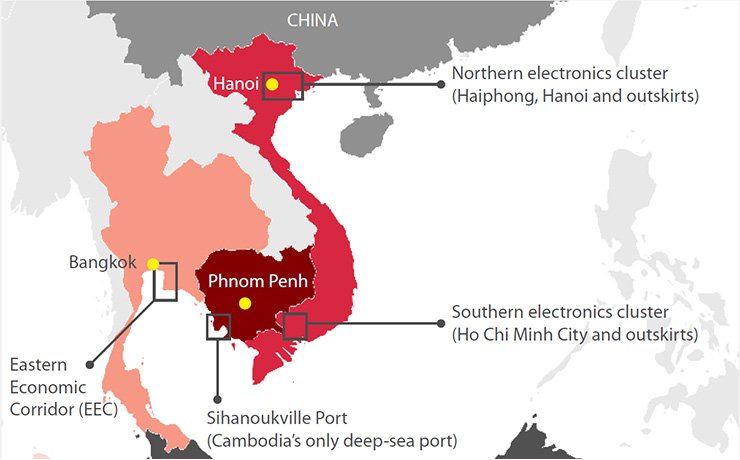

Reconfiguration of supply chains with stronger focus on Southeast Asia and India

Instead of leaving China, a “China +1” strategy has emerged out of this panel discussion as the most reasonable supplier strategy. In an attempt to reduce costs and diversify supply, multinational industry companies have already moved assembly to new locations, for example in Vietnam and India, over the last months and years. Small and medium companies have higher burdens to do so, but are expected to follow. What is missing around these new satellite factories in South East Asia and beyond, is deeper localization down to the level of single components. Also regional particularities have to be taken into account for the strategy. When choosing India as an alternative place of production, adapting to sudden spikes in demand can still be a challenge. In this case, Indian producers could take the role of providing a stable base load capacity, while Chinese companies could cover the more unplanned peaks.

In conclusion, the reconfiguration of supply chains in Asia has just begun. It will take time, but is possible. Taking the example of the automotive industry, a lot of industrial tooling and component manufacturing expertise is still in Germany, France, Spain, the Netherlands, Eastern Europe or North America and big companies from these countries still have organizational capabilities to carry out supplier development projects and trainings in South East Asia and India. Small and medium sized companies don’t have these resources, but instead can rely on consultancies such as GetAhead Pte. Ltd. to help with the reconfiguration. GetAhead’s expertise and networks in these markets supports SMEs that are keen to explore “China +1” strategy but are uncertain on where and how to begin.

The Panelists