Addressing Labour Market Tightening in Vietnam: Insights for Foreign Companies

Vietnamese manufacturing enterprises start to encounter at least short-term constraints in the labour market. Part of the reason is that trained workers are leaving for foreign-invested companies or they seek opportunities to work abroad through labour cooperation programs.

Examples of Industries Affected by the Slow but Steady Labor Cost Rise in Post-Covid Vietnam

- Labour Market Tightening: There’s a growing difficulty in finding workers, as evidenced by companies like Pegatron and B. Braun, who are considering building dormitories for workers due to the scarcity of local labour.

- High Demand for Skilled Labour: Vietnam is experiencing a shortage of highly skilled labour, which is increasing in demand by companies. This is compounded by the expectations of young, highly qualified workers for salaries significantly higher than the minimum wage.

- Bureaucratic Challenges: The process of business expansion and investment in Vietnam is hindered by a slow, consensus-driven, and decentralized bureaucratic system. This includes delays in obtaining necessary approvals due to the requirement of multiple signatures for each process.

- Corruption Crackdown Impacts: A significant crackdown on corruption has led to what some describe as ‘procurement anxiety’ among government officials, further slowing down processes and decision-making in public sectors.

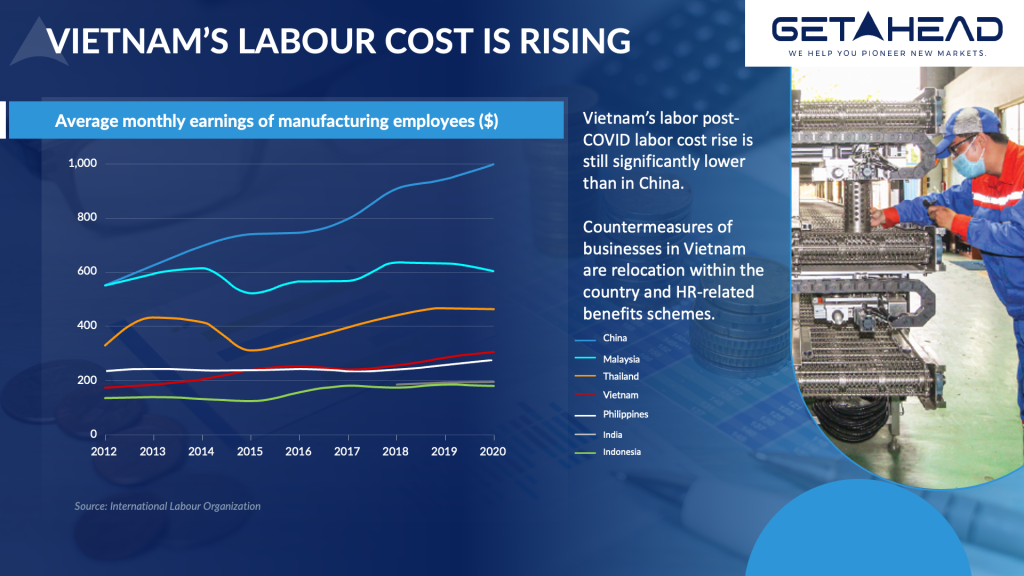

How the Labor Cost Rise in Vietnam Compares to Other Manufacturing Hubs in Asia

Similar to other Asian economies, such as the Philippines, this has caused Vietnam’s low labor costs to rise. However, as illustrated in the chart below, the increase is considerably less than that in Vietnam’s larger neighbor, the People’s Republic of China.

To further depict this, Viet Air Filters Manufacturing Corporation (VAF) needs to recruit 50 engineers and technicians due to expansion and to compensate for layoffs during the Covid-19 pandemic. However, despite offering accommodation benefits and a good welfare regime, the company struggles to attract workers from Ho Chi Minh City and other provinces.

Lap Phuc Company, which exports moulds to various countries, is also affected by this issue. Employees often leave for foreign-invested companies after receiving training at domestic firms. Fresh graduates in technical and engineering fields tend to initially join local companies but leave after gaining some experience, attracted by better prospects at FDI firms.

Counter Measures Being Implemented by Companies

However, Vietnam’s resource pool is far from being exhausted, and companies can adopt various strategies to tackle the problem. VAF, for instance, offers an average annual raise of 10% to retain employees, while Lap Phuc reviews salaries annually and offers additional incentives like a 13-month salary and a car allowance scheme for senior managers. Experts recommend that businesses focus on human resource development and create attractive mechanisms to draw young engineers and technicians from universities and colleges. Vietnam has seen a significant increase in wages since joining the World Trade Organisation (WTO), particularly in manufacturing sectors. Manufacturing workers earn notably higher wages than those in agriculture, fisheries, and forestry, leading to a migration of workers from rural areas to manufacturing hubs. Overtime work is also a crucial factor. Many workers rely on overtime pay to support their families, especially those from rural areas. However, there are legal limits on the amount of overtime that can be worked. Benefits beyond standard insurance are appealing to workers. These include flexible shifts, work-from-home options for non-factory roles, childcare, healthcare benefits, and free meals. Such benefits can attract and retain high-quality talent, especially for workers with families. Location is another critical factor. The pandemic has shifted the labor force, with many workers moving away from major manufacturing hubs to their hometowns. As a result, firms may find it advantageous to establish operations in areas with high job demand but fewer transient populations, such as Central Vietnam, which offers low-cost labor and developing infrastructure. Companies are also encouraged to move in clusters to industrial zones like Haiphong. This approach was demonstrated by Pyeong Hwa Automotive and three other companies moving to Haiphong in 2019. Improving supplier ecosystem also alleviates these issues, with large investors like Samsung playing a role in enhancing the supplier ecosystem by working with local companies to improve product quality.

The labour issues can be resolved with implementing strategies in view of what employees require when seeking for employment. The outlook for Vietnam’s economic growth remains positive, with expectations that the trend of companies diversifying away from China (“China plus one” strategy) will continue to benefit the country.